Microsoft and Yahoo get hitched in the search space

You'll have noticed that Microsoft is now going to be powering Yahoo's search. Well, it will be once the deal is done.To celebrate, the two companies set up a joint website to announce it.

They have finally got it together on advertising and search engine operations, with a view to take on the might of Google. Under this deal Yahoo is supposedly managing the ads side of the business and Microsoft will provide the necessary search engine platform. Rumours are that the two will share the revenues.

They have finally got it together on advertising and search engine operations, with a view to take on the might of Google. Under this deal Yahoo is supposedly managing the ads side of the business and Microsoft will provide the necessary search engine platform. Rumours are that the two will share the revenues.Microsoft has been chasing Yahoo around the corporate bedroom for years, but each time a consummation looked nigh, Yahoo proclaimed itself too expensive or just not interested and the deal fell apart.

An 18-month odyssey.

It was a partnership that was a long time in the making. Microsoft's search market share has been slipping for more than two years, and the company has struggled to make its online advertising unit profitable. Meanwhile, Yahoo, once the search market leader, dropped to a distant second place behind leader Google by 2007.

The dealings between the two companies began Feb. 1, 2008, when Microsoft made an unsolicited $44.6 billion cash and stock bid for Yahoo. A week later, Yahoo rejected the bid, saying the offer "massively undervalues" the company.

In June of last year, Microsoft said it was no longer interested in acquiring Yahoo outright, but would like to enter a deal for Yahoo's search advertisement business.

Bartz and Ballmer said those preliminary discussions involved more cash up front for Yahoo but a less revenue sharing. Bartz said Yahoo insisted on a higher revenue number so it could invest in its long-term projects like its core online media businesses.

Though many analysts speculated that Microsoft's immediate success with its Bing search engine, unveiled last month, was the final nail in the coffin, Bartz said there was no one thing that pushed the deal through.

"It was the understanding and trust that we could have a partnership, and that takes time," said Bartz. "Finally the comfort level was there, and the proverbial snowball went down the hill. Once we reached a point in which it was clear that a deal was advantageous to both companies, we moved forward."

Ballmer said, for Microsoft, the deal wasn't better than the original revenue-sharing proposal, "just different."

Credit card - Boon or Bane?

Buying things using plastic has graduated from being a life style statement to one of becoming a necessity in recent years.

We even see auto drivers (at least now in TV ads only) advising us to use the plastic version of money and not hard cash and even refusing to go to the ATM machine.

Of course the ad was for debit cards not credit cards! But using cards in one form or the other has today become the norm not the exception.

Travel any express train and we can see the number of online tickets beating the old form of counter tickets by atleast 4 to 1. It would be dumb to say "Don't use credit/debit cards".

Cards are similar to the TVs, Mobile phones, computers and internet which are technological advances/tools that are now an integral part of our lives. But the issue is that these tools have taken over so fast that many of us have not had the time to think of the best ways to use these tools

The best way to use a credit card is to pay the full amount specified in the bill before the due date. That way we get close to one month's credit (sometimes more) from the card company.

There maybe of course some charges in certain places for the usage of the card. If there was any during the month, most of the time the credit advantage gets nullified (goes back to zero).

Beware of impulse purchases using the credit card, they can run up a bill that we may not be able to pay when the bill comes in. The credit card companies grow in double digits (and survive at bad times) because of such purchases.

So what do we do when the purchase is beyond the repayment capacity? We are presented with 2 options:

We even see auto drivers (at least now in TV ads only) advising us to use the plastic version of money and not hard cash and even refusing to go to the ATM machine.

Of course the ad was for debit cards not credit cards! But using cards in one form or the other has today become the norm not the exception.

Travel any express train and we can see the number of online tickets beating the old form of counter tickets by atleast 4 to 1. It would be dumb to say "Don't use credit/debit cards".

Cards are similar to the TVs, Mobile phones, computers and internet which are technological advances/tools that are now an integral part of our lives. But the issue is that these tools have taken over so fast that many of us have not had the time to think of the best ways to use these tools

The best way to use a credit card is to pay the full amount specified in the bill before the due date. That way we get close to one month's credit (sometimes more) from the card company.

There maybe of course some charges in certain places for the usage of the card. If there was any during the month, most of the time the credit advantage gets nullified (goes back to zero).

Beware of impulse purchases using the credit card, they can run up a bill that we may not be able to pay when the bill comes in. The credit card companies grow in double digits (and survive at bad times) because of such purchases.

So what do we do when the purchase is beyond the repayment capacity? We are presented with 2 options:

- Pay the Minimum Balance

- Convert the purchase into an EMI (Equated Monthly Installment)

Both these options are negative in the perspective of the purchaser. The better option is to pay as much as possible so as to close the purchase amount in a month or two (and not purchase anything in the meantime).

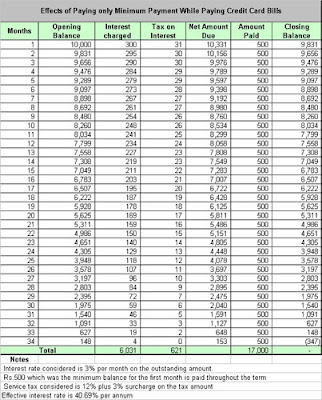

The table provided here illustrates the effect of paying only the minimum balance on the outstanding. See how long the term gets extended to and also the total amount (17,000) paid for a small principal (10,000).

The most important output from the table will be the effective interest rate. This is the interest rate charged on us when we pay off Rs.10,000/- over 34 months buy paying Rs.500/- monthly. The Effective interest rate in this case is 40.69% per annum. Is it worthy to pay such high effective interest rate to purchase anything? Think not.

This is another seemingly good idea. The plan is to convert the purchase say Rs 30,000/- into an "interest free" EMI. On the surface the deal sounds too good to be true, and we jump on it before the tele-caller (who usually offers the deal) thinks otherwise. The tele-caller goes on to say that there is only a one time service charge of some low percentage, the rest of the amount is totally free. Let us the calculation for one such offer:

Effective Interest Rate for 0% EMI Option with Credit Cards

Purchase: Rs 30,000

Term for repayment (in mths) 9 mths; 6 mths; 3 mths

EMI 3333.333; 5000; 10000

One Time Processing Charge 3370; 2400; 1200

Processing Charge % 11%; 8.0%; 4%

Effective Processing Charge Annualised % 14.98%; 16.00%; 16.00%

Thus we can see clearly that the Zero Percentage is not truly Zero, but a cool 15% to 16% more

This is article is not suggesting that the credit card companies are the big bad wolves out there to get you. Used well, the credit card can be a time saver (train tickets), face saver (just short of cash after a candle lit dinner with your girl friend) and a life saver (imagine carrying Rs 1L as cash at Timbaktu).

The way out of the darkness surrounding the usage of credit cards is through awareness and knowledge - Awareness of our buying / spending patterns and the knowledge about the various terms of use of the cards (time to dust up the pouch in which the card arrived or better ask the company for a new set up or if lucky your company may be among those who print the terms of use behind each bill).

Source: BankBazaar.com